For day traders, understanding trading indicators like the moving average is crucial—it can mean the difference between making big profits or suffering heavy losses. The moving average acts as a dynamic tool that tracks the overall direction of an asset’s price movements over a specific time period.

Whether you’re using the simple moving average (SMA) or the exponential moving average (EMA), grasping their subtleties can help traders spot potential entry and exit points, assess market sentiment, and differentiate between trending and ranging markets.

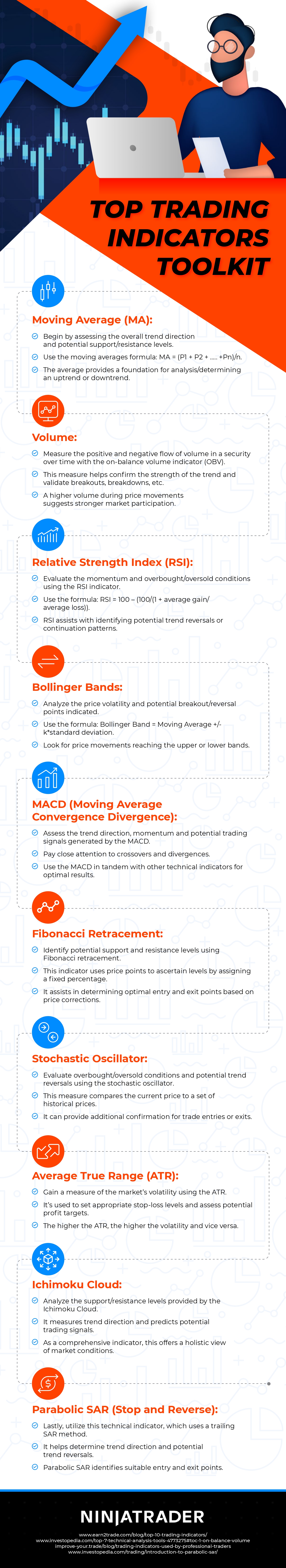

Interested in learning more about how the moving average can boost your success as a day trader? Continue reading on through the infographic provided alongside this post for more insights.

Top Trading Indicators Toolkit, provided by NinjaTrader, a provider of futures charting software